Degenerative Finance Presents “uSTONKS”

Please Note: We initially announced uSTONKS as a Quarterly Token. uSTONKS has since been changed to a Monthly Token and the post below revised accordingly.

Our mantra within the Yam DAO has been “Innovation required. Tyranny rejected. Economics redesigned.” We dream of a financial system that is open, fair, uncensored and trustless. The recent events in the financial markets have been disheartening to see. We recognize this moment as a turning point for all the builders in Decentralized Finance. This past weekend, the Yam Community voted to stand in support with Wall Street Bets and launch uSTONKS on the Degenerative Finance platform.

uSTONKS will be the next endeavor in our partnership with UMA Protocol and aims to reflect the ever-changing and exciting sentiment of the r/WallStreetBets community. With uSTONKS, DeFi users can earn liquidity mining rewards, hold a long position, or hold a short position.

uSTONKS, designed by UMA Protocol in their uLABS program, will be a synthetic that tracks an index of the ten most bullish Wall Street Bets stocks. Bullishness will be measured by the number of positive comments on the WSB subreddit, with data provided from Swaggy Stocks’s trend tracking.

The plan will be to update the uSTONKS basket regularly so uSTONKS can remain fresh and in line with WSB community’s favorite picks.

uSTONKS Details

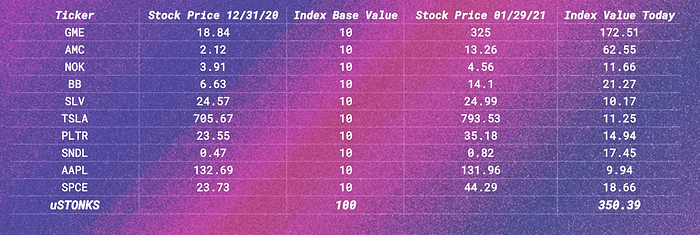

The 10 chosen tickers in the uSTONKS Index launch will be:

A base date will be set where the index is 100 and each stock represents 10 points on the index. The token will base its index off of the December 31, 2020 exchange closes. Each token will be weighed equally in the uSTONKS Index.

This Google Sheet, by the UMA Team, illustrates the calculations and shows how the Index has performed over the month of January. Feel free to copy the GOOGLEFINANCE functions in the sheet for your personal monitoring of the index value.

Here is a graph of how uSTONKS would have performed in January:

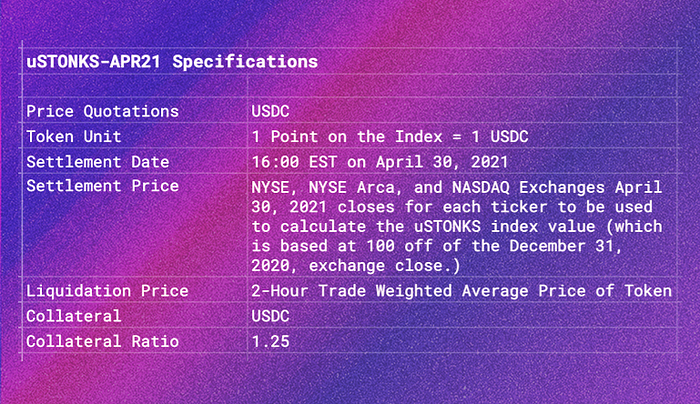

uSTONK will launch with a monthly token, uSTONKS-APR21, and its basket of Wall Street Bets tickers will rotate every quarter.

uSTONKS-APR21 will launch in March and run until end of April 2021. The token will expire at 4:00PM EST on April 30th, 2021. The exact closing prices on the NYSE, NYSE Arca and NASDAQ exchanges for each stock will be used to calculate the final settlement of the uSTONKS index.

Similar to uGAS and uVOL, uSTONKS will use the 2-hour TWAP of its own token price to determine whether a position is collateralized or needs to be liquidated. This self-referential logic is needed because uSTONKS is a decentralized synthetic that trades continuously 24/7 whereas the underlying stocks in the uSTONKS index trade during exchange hours which leaves gaps in prices between the 4:00PM EST close and 9:30AM EST open the next day and on weekends and market holidays. Using price feeds from the exchanges to monitor collateral ratios of token sponsors could be problematic outside of market hours especially if there is significant news released on a stock or meaningful macro market forces. Though some stocks are traded after hours, the ability to extract this price data is difficult and the frequency may not be consistent across all ten stocks. Therefore, using the uSTONKS token price itself to monitor collateral ratios is a better alternative as it should reflect the actual price movements during exchange hours and also reflect expectations of price movements after market hours.

One technical detail to discuss is how to treat corporate action that may alter the price of an individual stock such as dividends and stock splits. The uSTONKS index will not adjust for dividends. Tickers in the current index have little to no dividends being paid and most stocks pay dividends in a predictable manner so there should not be a major impact on the index value from this source. However, we have decided to account for stock splits in the index. If a stock does split we will simply adjust the base price accordingly and the final settlement would have no distorted impact and would only reflect the change in the market capitalization of the company. As with all price identifiers, if there are any unexpected events, UMA token holders will discuss and arbitrate on any issues that arise and use their judgement to come to a fair conclusion.

After a successful YAM community vote to list uSTONKS, YAM is excited to collaborate with UMA to give the uSTONKS token a home on the Degenerative Finance. Our goal is to have the uSTONKS token trade-able by the end of this month.

uSTONKS will launch with a liquidity mining rewards program to encourage users to both mint and provide liquidity for uSTONKS. A deep liquidity pool will be essential to helping make uSTONKS as accessible to as many users as possible.

YAM will receive developer mining from UMA rewards for all uSTONKS tokens minted. uSTONKS will be distributed as follows:

- 82% Liquidity Mining (to users who both Mint and LP uSTONKS.)

- 8% dAPP Mining

- 10% Management Fee to YAM Treasury

Also please note that since the space is moving so quickly, uSTONKS token specifications could be subject to change!

Conclusion

After the recent financial events, we recognize that we’re in a pivotal time for Decentralized Finance and the actions taken today can dramatically affect the future. We believe in a future that is decentralized. A future that is open and fair. A future that is community driven. The teams at YAM, UMA, and uLABS, hope that uSTONKS can be a small part of helping our industry stay on this arc.

uSTONKS. 24/7 WSB Trading. Coming soon. 💎👐